The Changing Landscape of Cryptocurrency Mining and the Potential Impact on Bitcoin Miners

In the dynamic world of cryptocurrency mining, Bitcoin miners with favorable energy contracts are now becoming key targets for potential mergers and acquisitions, as highlighted in a recent report from JPMorgan. With the industry evolving rapidly, the consolidation of players who have access to efficient and sustainable energy sources could offer a significant advantage in the competitive realm of digital asset mining. This article delves into the implications of JPMorgan’s findings and how it could shape the future of the Bitcoin mining sector.

Exploring New Opportunities for Bitcoin Mining Companies

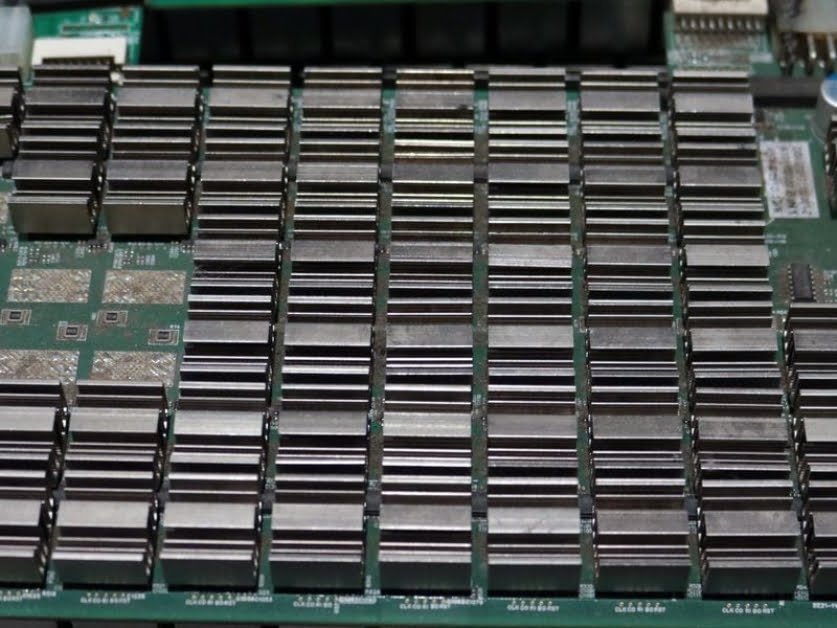

Hyperscalers and artificial intelligence (AI) companies are actively seeking innovative solutions to meet their energy requirements. This quest has led them to consider acquiring Bitcoin mining companies with attractive energy contracts, according to JPMorgan. A hyperscaler is a large-scale data center that specializes in providing substantial computing power.

Recent Developments in the Mining Sector

The aftermath of the halving event has sparked a wave of mergers and acquisitions within the mining sector. Core Scientific’s deal with CoreWeave, a cloud computing company, has garnered attention. This deal, involving a 200-megawatt AI contract with the Bitcoin miner, has underscored the sector’s shift towards high-performance computing (HPC). Additionally, CoreWeave was reportedly approached for an all-cash acquisition by Core Scientific. Similarly, other significant players like Come up Platforms and Bitfarms have engaged in acquisition offers, signaling a period of increased activity in the sector.

Implications for the Industry

JPMorgan’s analysis suggests that the CoreWeave deal could set a new benchmark for valuation within the industry. It may also lead to a redistribution of energy resources, benefiting larger operators while potentially pressuring smaller, sub-scale miners. The report estimates that U.S.-listed Bitcoin miners currently utilize up to five gigawatts of energy, with access to an additional 2.5 gigawatts, making them attractive targets for potential acquisitions.

Challenges and Opportunities for Bitcoin Miners

Some Bitcoin miners are facing financial pressures following the halving event, making them more amenable to potential deals. Broker Bernstein has identified Come up Platforms as a key player with the financial capacity to lead consolidation efforts within the mining sector. This presents both challenges and opportunities for miners as they navigate a rapidly evolving landscape.

In Conclusion

As the cryptocurrency mining sector continues to evolve, the focus on energy-efficient operations and strategic partnerships is becoming increasingly vital. The recent trends in mergers and acquisitions underscore the industry’s dynamic nature, with Bitcoin miners at the forefront of these developments. By leveraging efficient energy contracts and exploring new opportunities for growth, miners can position themselves for long-term success in this competitive space.